Dow’s Could Beneficial properties Disappear

The Dow Jones index has surrendered most of its positive factors from the start of Could, dropping 2000 factors in simply two weeks. This sharp decline has shifted the outlook from short-term bullish to one among near-term warning. Patrons beforehand entered the market above 37,000 in mid-April and round 37,850 on the finish of the month, indicating these ranges would possibly supply some assist. A shut beneath the mid-April low might immediate the index to check the 200-day easy shifting common (SMA) for the primary time since November.

Within the brief time period, a shut again above 38,500 might point out {that a} backside has been reached.

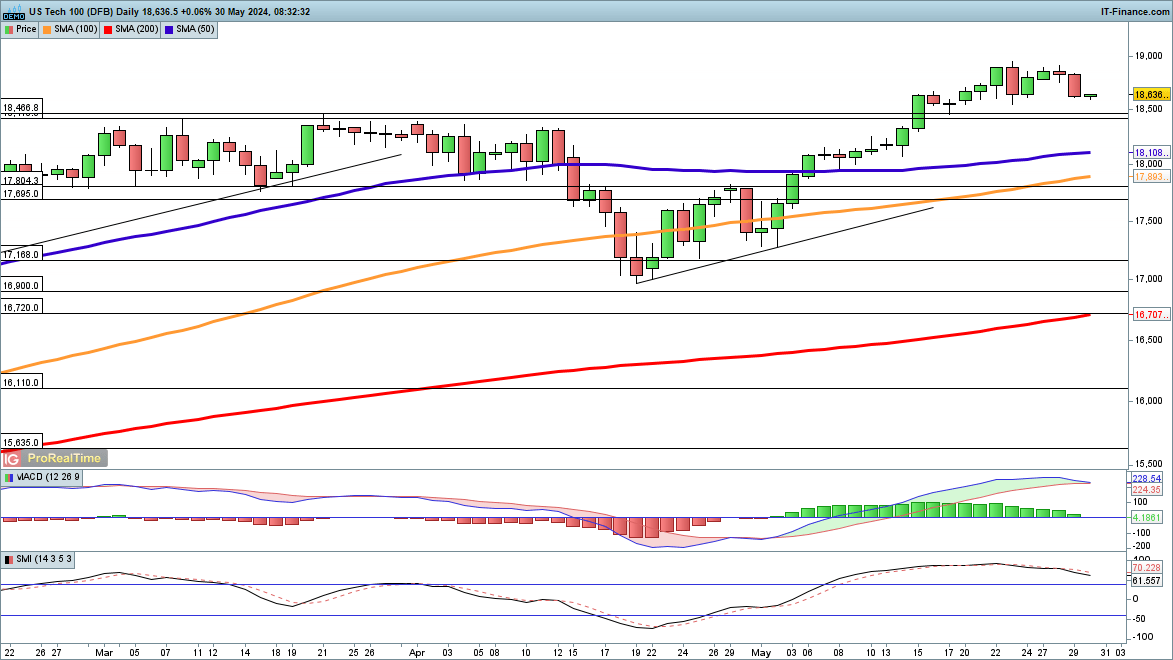

Nasdaq 100 Losses Restricted So Far

Power in know-how shares has thus far shielded the Nasdaq 100 from the extreme losses skilled by the Dow within the latter half of the month. The index stays near its earlier highs, and a shut above 18,800 might sign the start of a brand new upward transfer in the direction of 19,000.

Conversely, a shut beneath 18,400 would push the value beneath the highs set in February and March, doubtlessly resulting in a check of the 50-day SMA.

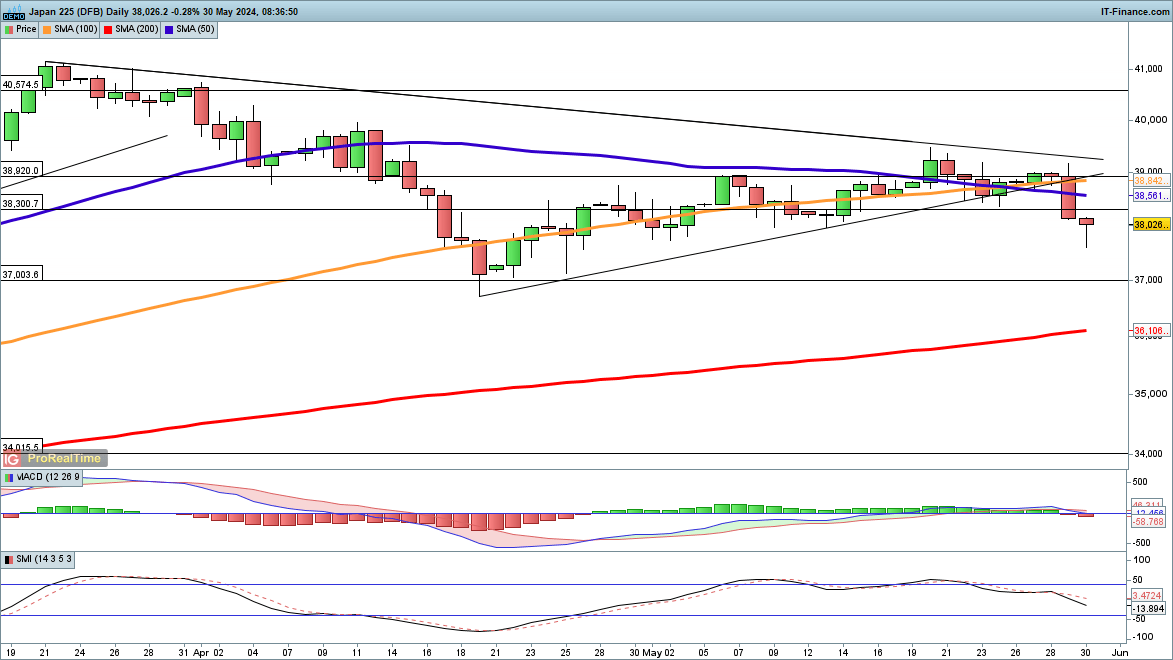

Patrons Emerge at Nikkei Session Lows

Wednesday’s session introduced important losses for the Nikkei 225, leading to a detailed nicely beneath the trendline assist established from the April low. The worth reached a three-week low, and Thursday’s buying and selling noticed additional declines, briefly hitting a one-month low. Whereas patrons have stepped in at at this time’s session lows, they might want to push the value again above 38,300 to counsel some stabilization.

Additional declines from the present degree might result in a drop towards the mid-April lows of round 37,000.

The submit Dow and Nikkei 225 Expertise Promoting Strain, Nasdaq 100 Losses Contained appeared first on Dumb Little Man.